Ripple (XRP) is on a profitable streak proper now.

Yesterday, the world’s third-largest cryptocurrency jumped 12% larger after Coinbase confirmed it might checklist XRP on its Coinbase Professional platform.

Now there’s an XRP index within the works, and there’s a great likelihood it is going to be listed on the Nasdaq, the world’s second-biggest inventory trade.

Bitcoin and Ethereum Indexes Now Dwell on Nasdaq

On February 25, Nasdaq launched the long-awaited bitcoin and ethereum indexes on its platform.

The indexes, powered by Brave New Coin, goal to supply a steady, correct spot value for the cryptocurrencies. The itemizing on Nasdaq is a big step ahead for the crypto business and a nod of approval from Wall Avenue.

Hidden in yesterday’s announcement, Courageous New Coin confirmed that it was within the “final stages” of launching a Ripple Liquid Index. With Nasdaq already on board as a associate, it appears inevitable that the XRP index itemizing will observe.

Nasdaq itemizing of BNC’s Bitcoin and Ethereum liquidity indices goes stay https://t.co/d3qei1tqTL

— Courageous New Coin (@bravenewcoin) February 26, 2019

A Springboard to a Bitcoin ETF?

Merchants have principally brushed over the launch of crypto indexes on Nasdaq, nevertheless it’s an enormous improvement.

As CCN beforehand reported, the approval of crypto indexes may fast-track approval of bitcoin funding merchandise, like a bitcoin ETF. The Bitcoin and Ethereum Liquidity Indexes (BLX and ELX, respectively) will carry value transparency and stability to the market. As Courageous New Coin’s CEO explains:

“There may be nonetheless nice value disparity between exchanges and international locations, diverging by as a lot as US$1,000 at any time.”

The indexes on Nasdaq will repair this by making a composite value from a number of exchanges. The itemizing may even combine Nasdaq’s surveillance expertise to assist determine and stamp out value manipulation.

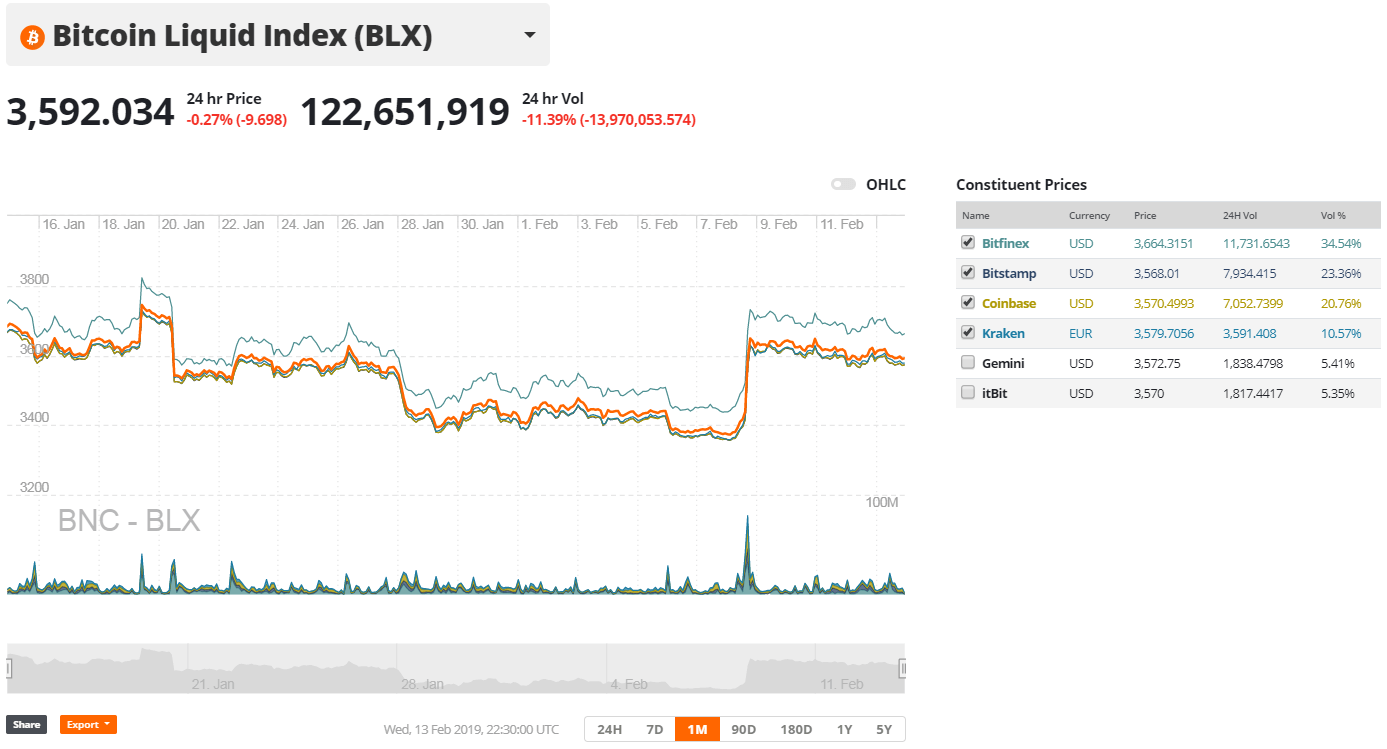

The Bitcoin BLX index offers a stable price, in comparison with Bitfinex’s excessive premium. | Supply: Courageous New Coin

The transfer will assist tackle the SEC’s fundamental issues of manipulation and value disparity in crypto. The forthcoming ripple index will solely develop the transparency and belief in cryptoassets.

A Benchmark Ripple (XRP) Value

Courageous New Coin’s ripple index will launch below the ticker RLX and bear in mind a number of trade prices. On the time of writing, Coinbase Professional isn’t a part of the collaborating cryptocurrency exchanges, however that would change as liquidity grows.

Just like the bitcoin and ethereum indexes, RLX will absolutely adjust to laws set by the Worldwide Group of Securities Commissions (IOSC). It will additional assure institutional belief within the indexes.

“BNC’s ‘Liquid Index’ (LX) indices are half qualitative and half quantitative, factoring within the stability and high quality of constituency in addition to the quantity, e-book depth, tick measurement and different components from the certified market individuals, to calculate a good world worth for the value of Bitcoin and Ethereum, expressed in USD, each 30 seconds.”

A Big Week for XRP

Newsflash: Coinbase Unveils Plans to Lastly Record Ripple (XRP) https://t.co/6MRC9Qq3CU

— CCN.com (@CryptoCoinsNews) February 25, 2019

After years of rumors, Coinbase lastly confirmed that XRP could be made out there to merchants.

As of Monday, Coinbase Professional is accepting XRP deposits. When enough liquidity is reached, buying and selling will likely be switched on within the US (excluding New York), Canada, Singapore, UK, Australia, and different European nations.

Merchants responded positively, sending the value up 12%. After a quick retreat, XRP is at present buying and selling at $0.32, in response to the CCN price index.

0 Comments